MORI VPN is live: free, ad‑free, and built for serious anonymity

MORI launches MORI VPN — a free VPN client (with TOR mode) for Android, Windows, and macOS. No subscriptions, no ads, no speed limits, and access via an activation key.

Yesterday

Latest news

MORI VPN is live: free, ad‑free, and built for serious anonymity

MORI launches MORI VPN — a free VPN client (with TOR mode) for Android, Windows, and macOS. No subscriptions, no ads, no speed limits, and access via an activation key.

Yesterday

MORI Games Premiere Set for October 30 — “The Biggest Show in the CIS”

MORI announces the premiere of MORI GAMES, a large-scale entertainment series blending viral challenges, real prizes, and token-driven mechanics. The ecosystem enters a new stage with double-digit growth ahead of launch.

26 Oct 2025, 10:00

Team $MORI Publishes Update — Is Growth Next?

A fresh $MORI update just landed: releases are near and new demand surfaces for the token. Here’s what’s already in place and why it matters right now.

29 Sep 2025, 22:39

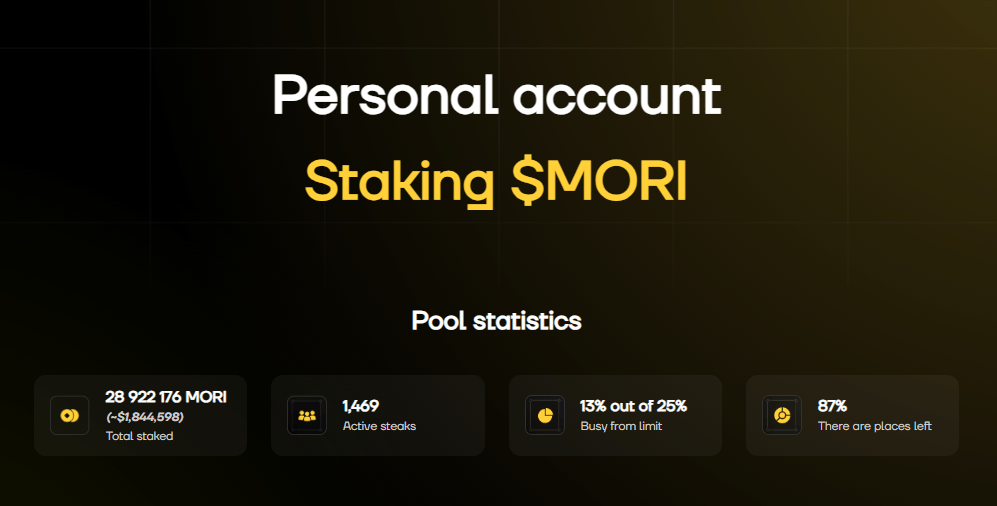

MORI Launches $50,000 Drop: Stakers to Receive $2,000

On September 30, MORI will take a wallet snapshot. Among stakers, $50,000 will be distributed — $2,000 to each of 25 winners.

29 Sep 2025, 12:21

MORI Tokenomics — Analytical Review

Clear, data‑driven take on MORI in 2025: staking‑driven supply contraction, VPN‑driven transactional demand, and fee‑funded burns; liquidity centered on Raydium.

27 Sep 2025, 09:25

MORI vs Meme Tokens — Explained Simply

Clear explainer of what MORI is, how it differs from meme coins, current and planned utilities (staking, casino, VPN), community scale, and key risks.

26 Sep 2025, 10:25

What We Know About MORI VPN So Far

MORI announces its second ecosystem utility—MORI VPN—with token-linked pricing, TOR-over-VPN mode, and app distribution; launch timing awaits an official date

18 Sep 2025, 20:20

Mori Coin: from meme to ecosystem project

An overview of the MORI token, its utilities, roadmap, and risks for global holders.

17 Sep 2025, 09:00

Mori Coin Launches Staking and Surges 50% in Just 2 Days

The first utility in the ecosystem sparked investor interest in MORI and became a major price driver.

16 Sep 2025, 09:00