MORI Tokenomics — Analytical Review

MORI Tokenomics — Analytical Review

MORI is a Solana‑based ecosystem token built around three economic pillars: supply contraction via staking, transactional demand via a VPN product, and a potential deflationary loop through burning a share of fees from a forthcoming casino.

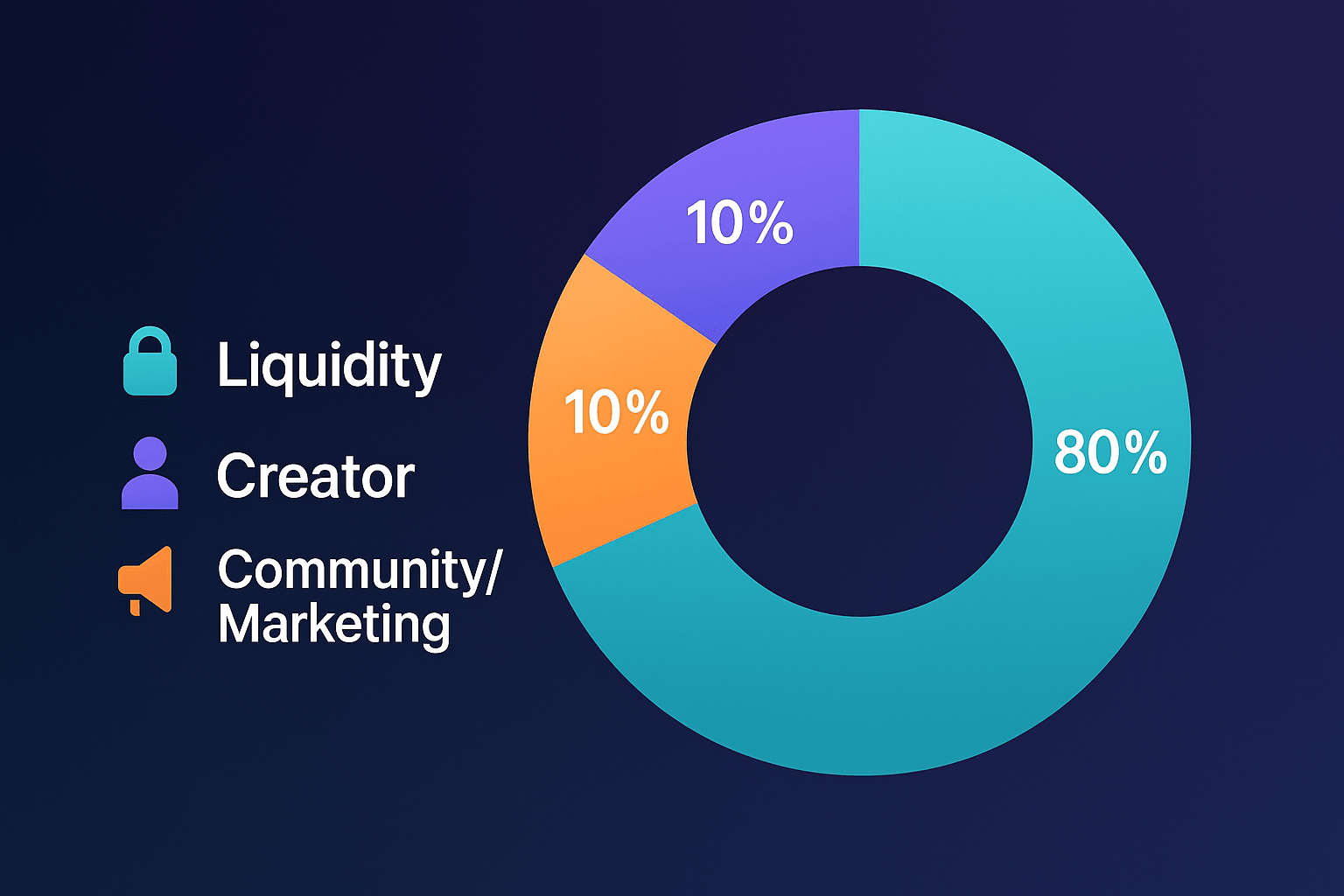

Supply and Distribution

The base parameters are straightforward: the aggregate issuance is around one billion SPL tokens; the mint address is 8ZHE4ow1a2jjxuoMfyExuNamQNALv5ekZhsBn5nMDf5e . Public communications reference an “80/10/10” framing: the majority toward liquidity, a creator allocation mirrored by a community/marketing allocation. This structure reduces the likelihood of abrupt supply manipulation, but by itself does not generate demand; demand emerges where there are real product use‑cases and incentives for holders to keep tokens locked for longer horizons.

Demand–Supply Mechanics

Staking in MORI is designed to make circulating supply “sticky.” Yields scale with the length of the lockup, and early exits incur a penalty. Functionally, this is a voluntary time lock that lowers freely circulating supply and steadies the order book. The second vector is MORI VPN. Access is stated to be included for stakers, while non‑stakers are expected to pay in $MORI at a materially better rate than in fiat or stablecoins. From a token‑design perspective this creates a direct payment rail—i.e., a source of “utilitarian” demand that is less sensitive to market mood. The third vector is the casino and media slate. The gaming economy follows a rake model with no additional token issuance, with a portion of fees routed to burns. If volumes become meaningful, this adds a structural deflationary impulse on top of staking.

Markets and Liquidity

Liquidity is concentrated in a single major MORI/SOL pool on Raydium (CPMM). At the snapshot time the price hovered around $0.03794, total liquidity stood near $1.54m, 24‑hour turnover around $1.37m, with more than 3.5k trades over 24 hours and a ~−4% daily change. Fully diluted valuation and market capitalization moved in tandem—about $38m and $34m respectively. In addition to the main pool there are smaller mirror pools on Raydium (including CLMM) and Meteora, plus a thin USDC pool; their depths are in the thousands and hundreds of dollars, serving price mirroring and arbitrage more than sizeable execution. In practice, the dominant entry/exit point is the main CPMM pool; its state governs execution quality and potential slippage for most participants.

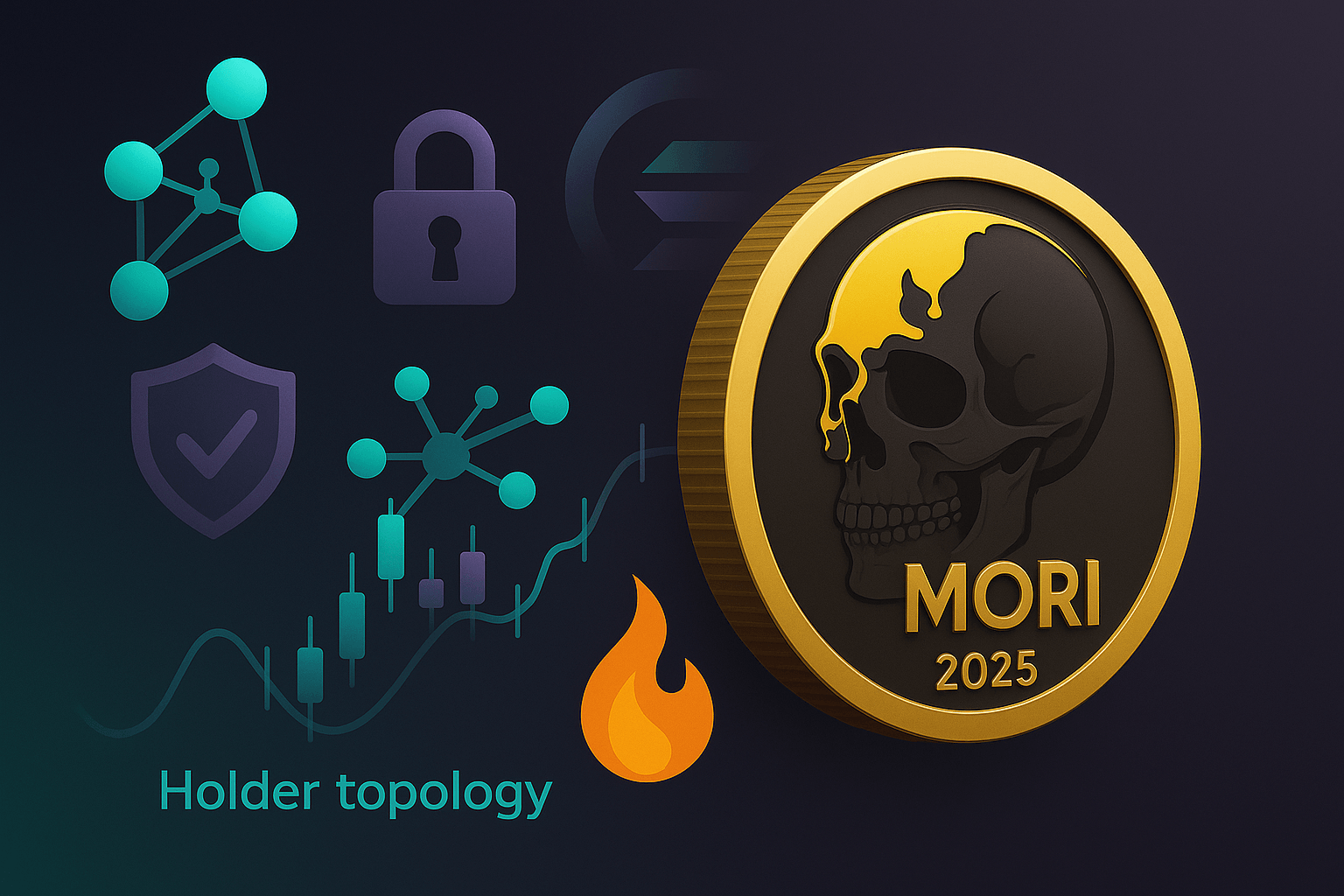

Holders and Concentration

The holder landscape resembles a “star” topology: related addresses cluster around central hubs, with periodic large transfers between them. This pattern is typical of projects with active market infrastructure: during redistribution phases, liquidity in the primary pool reacts first. Observing clusters reveals not only concentration but also habitual flow routes—useful context when interpreting price and volume impulses in real time.

Risks and Interpretation

MORI’s strength is the combination of three distinct mechanisms: time‑based supply withdrawal via staking, creation of transactional demand via VPN, and a potential deflationary effect from fee‑funded burns in gaming. The weak spot is sensitivity to product execution: without actual VPN users and sustainable gaming volumes, the token remains tethered to the speculative cycle. Another factor is liquidity concentration in a single pool: this makes the market transparent and easy to monitor, but amplifies the price impact of large orders over short intervals. In this configuration, durability depends on how quickly “utilitarian” demand catches up with the narrative and can sustain a balance between turnover and the pace of supply withdrawal.

Conclusion

MORI’s token‑economic design deliberately balances supply constraints with demand cultivation. If the VPN and gaming products achieve real adoption and turn into stable consumer flows, staking and burns will cease to be episodic features and become the structural backbone of the pricing model. At this stage the gravitational center is the main Raydium CPMM pool; its metrics are the clearest proxy for the current state of the MORI market.

Links